|

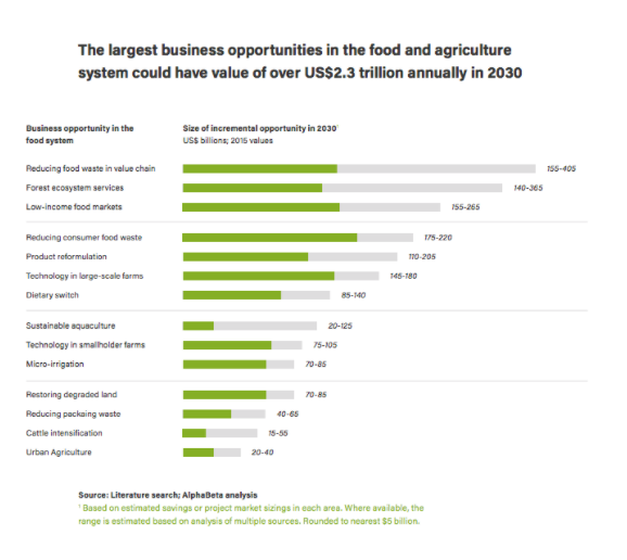

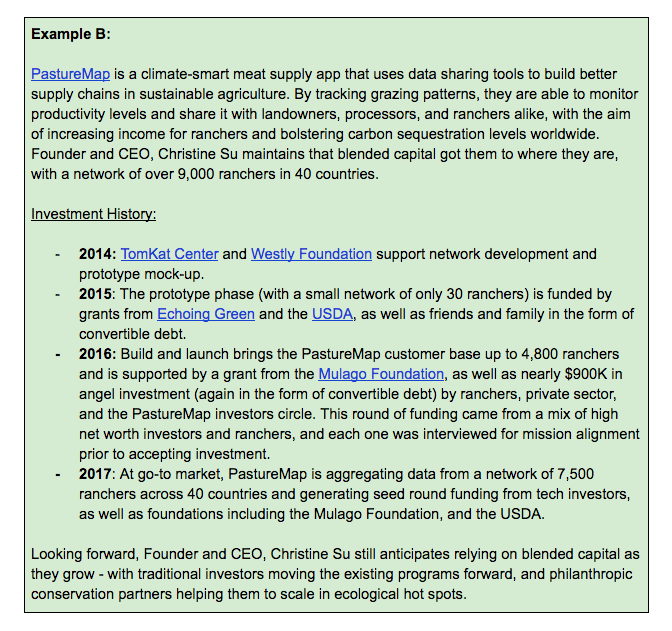

By Renske Lynde As we discuss the benefits of blended capital for early stage entrepreneurs (ESEs), the inevitable questions arise around benefits for both foundation and venture investors. “Intelligent capital,”(1) as Katie McCann calls it in the FS6 and Guidelight Capital Webinar, is capital that recognizes the value of early-stage sustainability organizations, and it is becoming increasingly important for investors on both sides of the aisle to recognize the potential impact of participating in these sectors. What we often see is that, in their early stages, mission-driven for-profit organizations need the support of philanthropic capital - whether grants, PRIs, MRIs, etc. - in order to get off the ground and open themselves up to more traditional funding streams. In her eloquent article on Catalytic Capital, MacArthur Foundation Managing Director Debra Schwartz applauds philanthropic funding as “patient, flexible, risk-tolerant financing.”(2) Looking back at the ROI trifecta of reward, risk and impact from Part I of this article, it can be seen that mission-driven ESEs offer a unique balancing of social capital with risk, in a way that traditional for-profits do not. As such, these ESEs should be viewed in conjunction with the non-profit organizations that are generally sought out for philanthropic funding opportunities. Even at their earliest stages, the impact of these investments is built upon the social capital of inquiry - learning more about the strengths and weaknesses of the systems that we are trying to change; exploring new outlets and avenues for innovation; and, perhaps most importantly, when successful, building an economic future where the mission-driven goals of foundation partners is built into the fiber of the new food system. In further reflection on the MacArthur Foundation’s investments in these types of ESEs, Schwartz points out: “The effects of our investments will live on long after the last loan is repaid. This is the hidden leverage of catalytic capital: intermediaries and enterprises that we supported are continuing their work, growing stronger and more capable."(3) By investing in these organizations, foundations allow for the growth of mission-forward enterprises in a marketplace that traditionally rewards revenue-first models. By doing so, they are supporting change makers in a system that desperately needs models for innovation and business leaders who advocate for broad scale transformation. Philanthropic investment in these innovative ESEs has the added benefit of creating an “unlocking effect”(4) that can open up other revenue streams for entrepreneurs. By stepping into an investment opportunity in the early stages of development, foundations are de-risking the investment for other funders who would like to follow suit. As Guidelight’s Katie McCann points out, this initial vote of confidence can give market credibility and commercial viability to a new technology,(5) and pave the way for those who are hesitant to take the first step. The arguments for traditional investors are, ultimately, a bit more streamlined. From a market analysis perspective, the growth and opportunity in the food space is unprecedented right now, promising an estimated worth of “over US$2.3 trillion annually for the private sector by 2030.”(6) Not to mention, the consumer demand for sustainability-focused solutions is skyrocketing - with Unilever reporting that one third of all consumers worldwide are making purchasing decisions based on the “social and environmental impact” of the product.(7) It is worth pointing out that, to investors looking for a more traditional ROI process, the mission-forward approach may feel daunting. However, thanks to the increased consumer demand for innovation in the food space, more and more funders are open to the process. The rabbit and the hare return with their proverbial lessons and sustainable investment is finally pulling ahead in the race. ** NOTE: For examples outside of the food space, it is worth diving deeper into the MacArthur Foundation early investment in the affordable housing sector, microcredit lending and the US Community Development Financial Institutions. However, for the sake of this article, suffice it to point out Schwartz’s declaration that “decades later, investments we made helped pave the way for others. Our early bets helped build strong, resilient enterprises.”(8) In a very crowded and often noisy space, early stage companies who are supported by a blended capital approach and who have philanthropic and impact-oriented support can be at a strong advantage. They can access not only the knowledge base that foundations/philanthropy possess, but also the access to the communities that those foundations have historically supported. They can also access the kinds of resources that can help them make a stronger case for their impact, such as evaluation services, etc. For those looking to invest in these types of ESEs, it is important to assess where you stand on the risk-return scale and identify companies that are mission aligned. While venture capital firms have teams dedicated to doing this sort of research and analysis, foundations and smaller-scale investors may not have these resources. For those in this position, intermediary organizations like Food System 6 or Prime Coalition can be valuable resources for identifying and connecting with viable partners and entrepreneurs. SOURCES:

(1) McCann, Katie. “FS6 and Guidelight Capital Webinar.” Food System 6. https://foodsystem6.wistia.com/medias/hvianqtp2f (accessed March 17, 2018). (2) Debra Schwartz. “Catalytic Capital: An Essential Tool for Impact” MacArthur Foundation, Director’s Reflection. https://www.macfound.org/press/directors-reflection/catalytic-capital-essential-tool-impact (accessed March 17, 2018). (3) IBID (4) Debra Schwartz, interview by Kiersten Marek, Inside Philanthropy. https://www.insidephilanthropy.com/home/2015/10/26/inside-macarthurs-impact-investing-a-conversation-with-debra.html (accessed March 17, 2018). (5) McCann, Katie. “FS6 and Guidelight Capital Webinar.” Food System 6. https://foodsystem6.wistia.com/medias/hvianqtp2f (accessed March 17, 2018). (6) “Valuing The SDG Prize in Food and Agriculture: Unlocking Business Opportunities To Accelerate Sustainable and Inclusive Growth.” A paper from AlphaBeta commissioned by the Business and Sustainable Development Commission. http://s3.amazonaws.com/aws-bsdc/Valuing-SDG-Food-Ag-Prize-Paper.pdf (accessed March 16, 2018). (7) “Report shows a third of consumers prefer sustainable brands.” Unilever. https://www.unilever.com/news/Press-releases/2017/report-shows-a-third-of-consumers-prefer-sustainable-brands.html (accessed March 19, 2018). (8) Debra Schwartz. “Catalytic Capital: An Essential Tool for Impact” MacArthur Foundation, Director’s Reflection. https://www.macfound.org/press/directors-reflection/catalytic-capital-essential-tool-impact (accessed March 17, 2018). Comments are closed.

|

FS6 is a nonprofit based in the San Francisco Bay Area whose mission is to support impact-driven entrepreneurs as they transform how we grow, produce, and distribute food. The organization runs a comprehensive accelerator program that mentors entrepreneurs by coaching them through a wide range of business and organizational needs. FS6 also works to educate stakeholders on the unique capital needs as it relates to redefining the food system. Categories

All

Archives

August 2021

|

RSS Feed

RSS Feed