PROGRAMS

At FS6, we believe that healthy soil starts with healthy balance sheets.

We are reimagining the capital supply chain, starting with federal farm safety net programs, which currently are a poor fit for most regenerative producers. Our strategy pilots new financial innovations that increase immediate access to capital while building the data sets needed to drive public sector adoption. When it comes to regeneration, our approach acknowledges the importance of helping producers stabilize first, then providing them with the resources and safety nets needed to adopt regenerative practices that improve soil, water, nutrient density, and community resilience.

Check out our programs that are keeping producers in business and changing the system for tomorrow.

GUARANTEES FOR REGENERATIVE AGRICULTURE (GRA)

Expanding access to capital for regenerative producers and the lenders who serve them

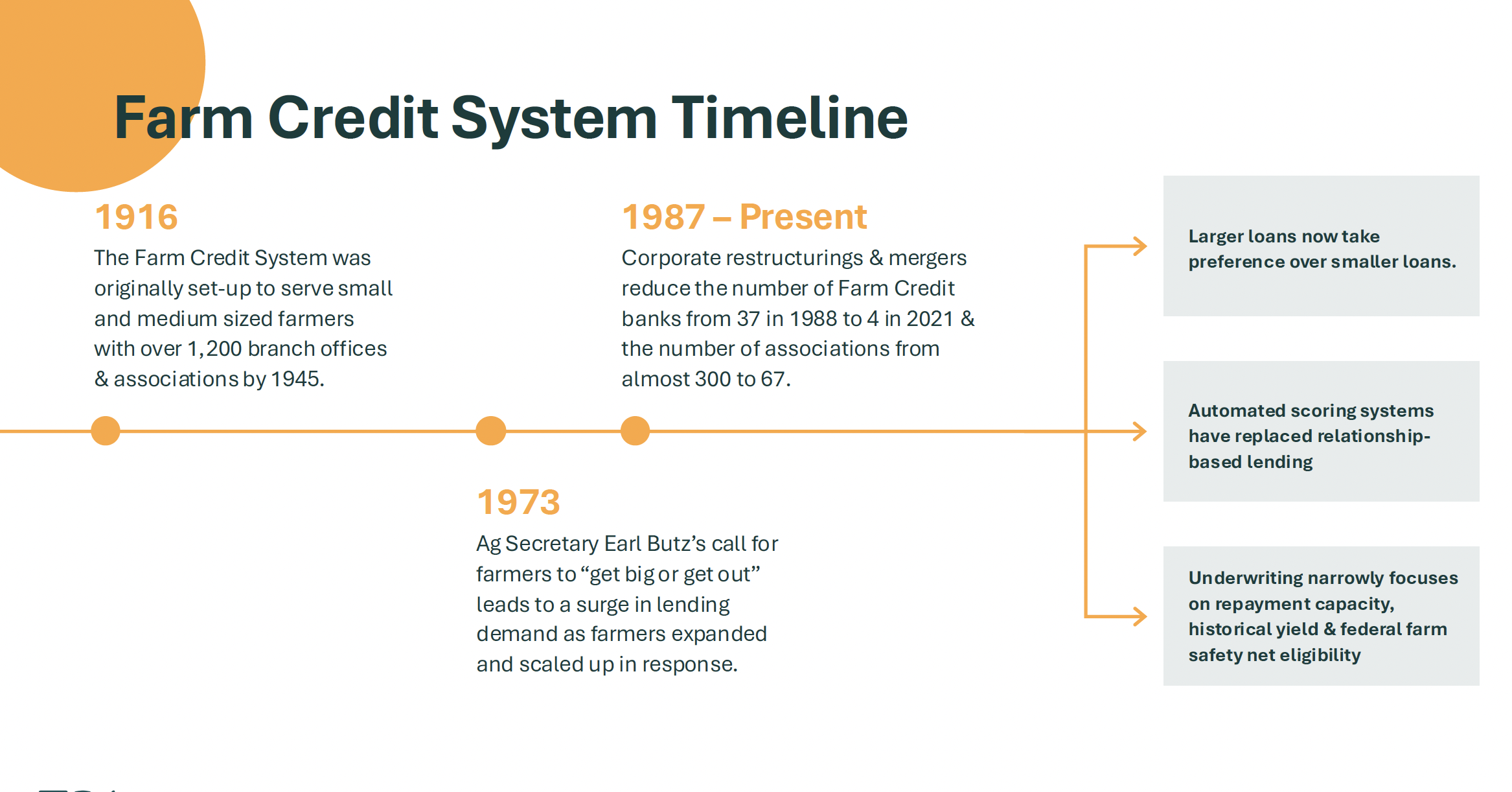

Over decades, agricultural finance shifted from local, relationship-based lending toward consolidation and standardized risk models. These changes reduced risk for conventional agriculture but made it harder for regenerative producers — who lack conventional safety net supports — to access capital. The timeline below illustrates these structural shifts.

As conventional lenders increasingly rely on standardized risk frameworks and public safety net programs that many regenerative producers cannot access, mission-aligned lenders are left without comparable risk-support tools—creating a structural constraint on their ability to lend.

Guarantees for Regenerative Agriculture (GRA) is the nation’s first pooled loan guarantee facility built specifically to expand access to fair, affordable capital for regenerative farmers, ranchers, and the mission-aligned lenders who support them. Regenerative producers, including diversified farmers, ranchers, and food businesses, are often excluded from conventional credit because traditional risk frameworks and federal safety net tools are tied to production systems that don’t reflect diversified, ecological operations.

By reducing lender risk through targeted guarantees, GRA unlocks mission-aligned financing from CDFIs, nonprofit loan funds, credit unions, and other innovative lenders, allowing them to provide loans that meet the real cash-flow and capital needs of regenerative producers. This helps farmers bridge cash-flow gaps, invest in regenerative practices, and grow resilient operations without sacrificing soil health or long-term viability.

How GRA Works

GRA operates as a pooled loan guarantee facility that shares risk with mission-aligned lenders financing regenerative and diversified producers. Rather than lending directly to farmers or food businesses, GRA provides guarantees to qualifying lenders—such as CDFIs, nonprofit loan funds, and other innovative lenders—who are already working with regenerative operations on the ground.

When a lender originates a loan to a regenerative producer, GRA can provide a guarantee on a portion of that loan. This risk-sharing mechanism helps lenders address common barriers such as limited collateral, lack of historical yield data, transition-period cash flow challenges, or ineligibility for federal farm safety net programs.

By reducing lender exposure, GRA enables more flexible underwriting, improves loan terms for borrowers, and expands the pool of producers who can access credit. Importantly, guarantees are structured on a case-by-case or portfolio basis, allowing GRA to adapt to different lending models, geographies, and borrower needs.

GRA is funded through commitments from philanthropic and mission-aligned guarantors, primarily structured as unfunded guarantee commitments rather than upfront grants, meaning guarantors commit capital that remains invested and is only drawn upon if a guarantee is called. Guarantors commit capital to stand behind a portion of potential loan losses, but retain control of their assets and keep them invested, earning a return, unless and until a guarantee is called.

This structure allows philanthropic capital to function as a precise risk backstop: unlocking significantly more private and mission-driven lending than a traditional grant, while preserving liquidity, flexibility, and leverage for guarantors.

In parallel, GRA aggregates and analyzes anonymized data on loan performance and underwriting practices. This data helps build the evidence base needed to demonstrate how regenerative lending performs in practice, inform future program design, and support broader policy and market shifts in agricultural finance.

GRA is not just about capital today — it’s about building the evidence base and infrastructure for long-term change in agricultural finance. By systematically capturing lending performance, underwriting insights, and risk outcomes, GRA creates a new data foundation that demonstrates how regenerative lending performs in practice, helping to inform policy reform and expand risk-support tools more broadly across the agricultural finance system.

In short, GRA delivers:

Capital today — by enabling lenders to extend affordable credit with confidence

Data to shift markets tomorrow — by building proof of performance for regenerative lending

A pathway to systemic change — by advancing risk tools that reward ecological outcomes and equitable access to credit

How agricultural lending involved and why it matters today

EQIP BRIDGE LOANS

The USDA’s Environmental Quality Incentives Program (EQIP) reimburses a portion of the expenses for conservation practices that improve soil, water, and biodiversity. But producers must cover those costs up front — a burden many cannot afford on razor-thin margins. For too many, this delays or even prevents them from taking advantage of public dollars.

FS6’s EQIP Bridge Loan Program removes this barrier with no-fee, no-interest bridge loan that aligns with EQIP contract timelines. Backed by the Soil Health Opportunities & Tools (SHOT) Fund, the program ensures that lack of liquidity is never the reason a producer can’t take advantage of EQIP funding. By closing this gap, we enable farmers and ranchers to implement regenerative practices faster, at greater scale, and with more confidence.

How The Program Works:

Application, Eligibility Review, and Introductory Call: Submit your application to the program here. Applicants with signed EQIP contracts in eligible states (see list below) will be contacted for a 30-minute introductory call to learn about your background, operation, and EQIP project.

Midwest: IA, IL, IN, MN, MI, WI, ND, SD

Southwest & California: AZ, CA, NM

Document Review and Holistic Evaluation: Submit supporting documentation for your project including a copy of your EQIP contract, project plans, and basic financial information. We conduct a holistic review, looking at the entirety of your goals and resources before making a loan approval decision.

Loan approval and funding disbursements: Once approved, loan funds will be disbursed directly to cover your project’s initial expenses, enabling you to start right away.

Loan repayment: Repayment aligns with NRCS reimbursements, allowing you to repay the loan smoothly once you receive EQIP funds.

To apply for an EQIP Bridge Loan, fill out this short application form.

EQIP Bridge Loan Borrower Spotlight

Wendy Johnson, Jóia Food & Fiber Farm

“The bridge loan assistance was very helpful in creating the cash flow flexibility my farm business needs without accruing high interest on an operating line of credit. As a small regenerative organic farmer, and due to the lack of scale, operating lines of credit are difficult to attain and cash flow can be tight in different times of the year. For example, in our farm business, spring time has much higher expenses than the fall and winter. Our NRCS contracts are usually not paid until the end of the year.

The bridge loan not only allowed increased flexibility but also allowed me to expand our farm business by purchasing grass-fed beef genetics when I was approached by the seller to purchase them, a relationship I have been growing for the last few years.

Having a farm business that sits outside of commodities that have insurance guarantees, it is important to create relationships. I am finding this to be true across the regenerative agriculture sector, relationships are more important to a regenerative farm business’ success than simply transactions. The bridge loan is a relational strategy that helps grow regenerative farm businesses long-term. ”