|

By Renske Lynde Building a company from idea into a successful and viable entity is among the most difficult challenges anyone can undertake. For entrepreneurs attempting to bring solutions into the marketplace that will have a positive and demonstrable impact on the health and sustainability of our food system, the challenges are even greater. The food system is highly complex, heavily regulated, and incredibly interdependent. In addition, the food system is made up of living elements and people who are subject to changing weather patterns, intricate logistics, evolving consumer preferences, and complex supply chains that are often intentionally designed for opacity. The range and scale of the challenges in our global food system requires us to chart innovative new paths towards solutions. One way we can leverage all the knowledge and capital required is to support the paths of early-stage entrepreneurs (ESEs) who are building scalable solutions. Speaking to the constraints around relying on the more established players for innovation, Christensen, Baumann, Ruggles and Sadtler of the Harvard Business Review point out:

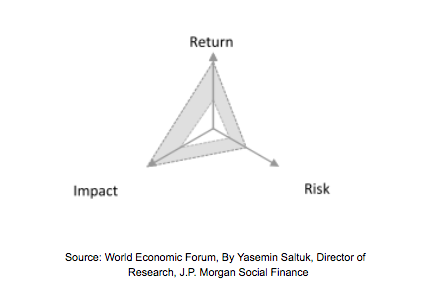

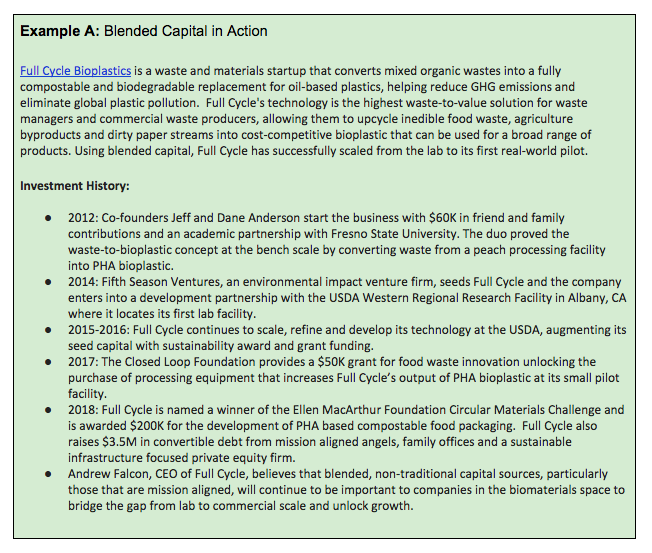

Early-stage entrepreneurs, on the other hand, are the breeding ground for innovation(2), untethered by the constraints of traditional structures and expectations; what’s more is that these organizations are still young enough to evolve and react to a changing food system and to build innovative thinking into the fiber of their ethos. It is for this reason that they are central to our ability to evolve and work through the complications of the current state of the food system which is, in the words of a senior leader at the World Economic Forum “not broken, but definitely not fit for purpose.” In many instances, these early stage entrepreneurs are coming from the communities that they want to affect change within and, as such, they have the passion and dedication to push towards solutions, challenge the status quo and integrate knowledge with an unprecedented capacity and motivation. That being said, entrepreneurs who are building solutions across the entire food value chain need a lot of technical support, as well as knowledgeable partners and access to their first customers; not to mention, the kind of capital financing support that will allow them to make an impact on their communities through their service, program or other solution. Unfortunately, this is one of the places where our traditional funding structure fails to meet the needs of a changing ecosystem. Mission-driven for-profits are often caught in a tricky situation where neither foundation funding nor venture investment meets the needs of their organization. One the one hand, due to the longer proof of concept cycles found in the food and agriculture ecosystem, the complexities of working within a quickly changing system, and the often slow adoption rates of farmers and ranchers, these ESEs often have longer Return On Investment (ROI) cycles than traditional investors are looking for; on the other hand they are often not considered for grants and foundation money due to their for-profit status. Despite challenging odds, many of these entrepreneurs persist and are driven by passion and a vision for a better food system that can transform how we grow, produce and distribute food. For these organizations, it is increasingly important that investor communities continue to adapt to a changing entrepreneurial landscape. Due to the complexity of the food system, and the particular challenges surrounding funding for mission-driven for-profit entrepreneurs, the next logical step is for ESEs, partners, and investors to explore the benefits of blended capital. Blended capital combines the mission based approach of foundation grants with the entrepreneurial spirit of traditional venture capitalism by leveraging both funding streams. However, in order to accurately discuss the value of blended capital, it is important to acknowledge that philanthropic investments are built upon an alternative model for investment return. Rather than building on the traditional, linear “risk vs. return” equation, these investments weigh ROI as a tripod of risk, return, and impact. As Jason Jay, Director of Sustainability Initiative at MIT Sloan, points out in the FS6 and Guidelight Capital Webinar, within this model, there are two types of blended capital investment - longitudinal blending and cross sectional blending(3). On the one hand, Longitudinal Blending comes from infusing an organization with different funding models at different life stages - focusing more on impact-driven, risk-tolerant funding streams in the early stages of growth, and shifting towards traditional investors, who may have a lower interest in impact and tighter focus on returns, as the enterprise becomes more established. Cross Sectional Blending, on the other hand, entails having a diverse portfolio of investors, with different metrics for impact and risk, at each stage of an organization’s growth. The blending of capital in this way allows entrepreneurs to entice low risk-tolerant investors with options such as preferred stock, while decreasing the financial impact for impact-driven investors by broadening the pool of investors. In either case, the true beauty of blended capital is that it offers non-traditional funding streams to mission-driven for-profit enterprises that will help them reach the milestones necessary for attracting more traditional funding opportunities. It is only by combining resources that the investor community will be able to support the complex demands (and tap into the rewards) of food system change. ** Stay Tuned for Part II of this article, where Renske Lynde will offer a deeper dive into the topic of blended capital, including examples of success and the benefits for investors. SOURCES:

(1) Clayton M. Christensen, Heiner Baumann, Rudy Ruggles, and Thomas M. Sadtler, “Disruptive Innovation for Social Change.” Harvard Business Review. https://hbr.org/2006/12/disruptive-innovation-for-social-change (accessed March 17, 2018). (2) Jim Bildner. “The Urgency to Fund Early-stage Social Entrepreneurs.” Stanford Social Innovation Review. https://ssir.org/articles/entry/the_urgency_to_fund_early_stage_social_entrepreneurs (accessed March 17, 2018). (3) Jay, Jason. “FS6 and Guidelight Capital Webinar.” Food System 6. https://foodsystem6.wistia.com/medias/hvianqtp2f (accessed March 17, 2018). Comments are closed.

|

FS6 is a nonprofit based in the San Francisco Bay Area whose mission is to support impact-driven entrepreneurs as they transform how we grow, produce, and distribute food. The organization runs a comprehensive accelerator program that mentors entrepreneurs by coaching them through a wide range of business and organizational needs. FS6 also works to educate stakeholders on the unique capital needs as it relates to redefining the food system. Categories

All

Archives

August 2021

|

RSS Feed

RSS Feed